Investor Relations

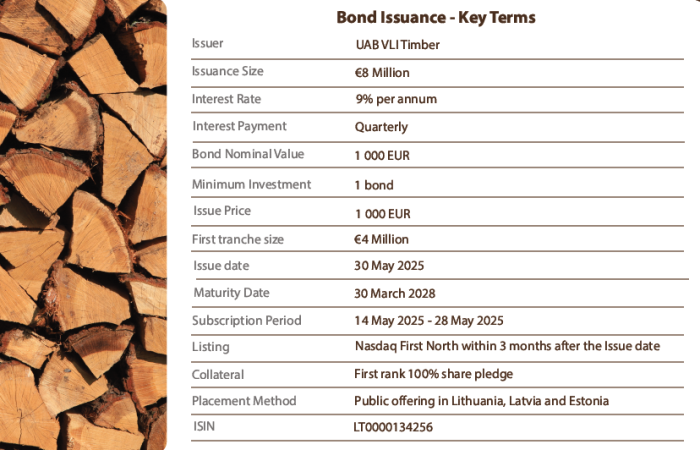

Starting May 14, 2025 Vli Timber is launching a public bond issuance in the total amount of EUR 8 M, distributed across two tranches of EUR 4 M each. The subscription period of the first tranche is 14 May 2025 – 28 May 2025.

Purpose of the Bond Issuance

VLI Timber is issuing bonds to raise working capital for the development of a new production facility in Jonava. The plant is expected to start operations in 2027 and will increase the company’s processing capacity from 120,000 m³ to more than 300,000 m³ of wood per year. The facility will be constructed by an external partner under a built-to-suit lease model and leased to VLI Timber upon completion. Bond proceeds will primarily be used to finance equipment procurement – a critical step for launching operations.

The company has secured €8.1 million in government subsidies, covering up to 80% of eligible equipment costs. However, these funds are available only after procurement, via a reimbursement model. Thus, bridge financing through bonds is essential to complete the investment cycle.

2025 06 16

During the bond placement, demand reached EUR 4.2 million, with approximately 450 investors participating in the public offering. Three-quarters of them were retail investors. Of all participants, 71% were from Lithuania, 11% from Latvia, and 18% from Estonia.

Retail investor orders were fully allocated, while institutional investor orders received partial allocations.

Key Documents

Key Documents

Supplement to Information Document